The ECB plans a digital Euro: it is decided in 2021

Euro: towards a digital dimension?

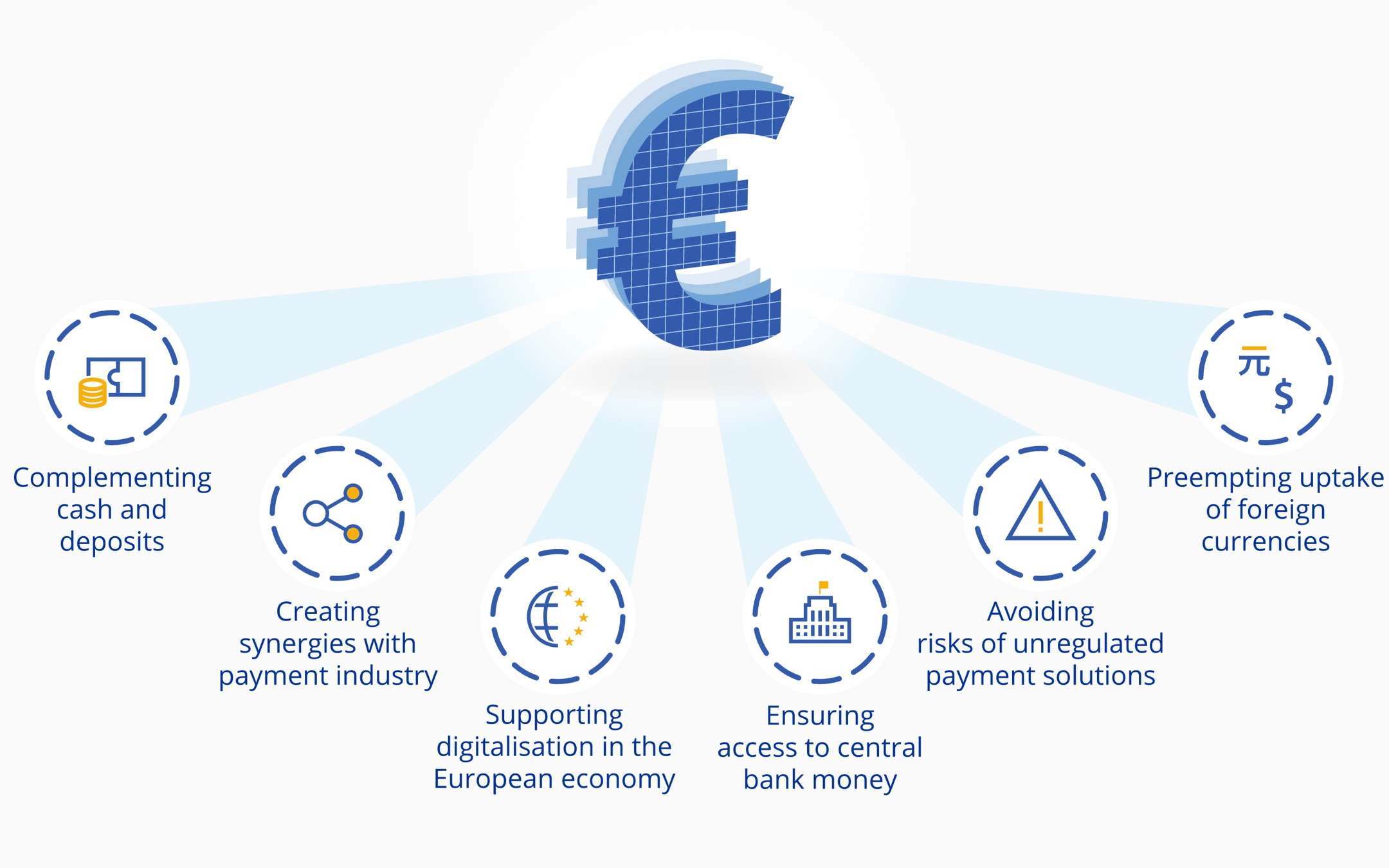

The digital euro would certainly go in the wake of cryptocurrencies only as a digital evolution of a currency destined sooner or later to dematerialize. In this project, however, the control is centralized and the digital dimension would simply be a complementary form to the traditional one. Logic has it that for every digital euro that appears, there would be a material euro that disappears, so as to leave the quantity of money in circulation always strictly under the control of the authorities.The goal, in short, is to maintain trust in money and sovereignty in money, preparing Europe for the issuance of a digital euro "should it be needed" (words of Christine Lagarde). A hypothesis, therefore. A perspective. A construction site to be opened, but for which there will be no hurry since only with maximum certainty it will be possible to put in place at least a first test phase.

The document is extremely complex and will require due analysis, but first of all it marks an important moment as it constitutes a turning point in European projects for a digital currency: the published study makes a propensity, or at least an important assessment , about the possibility of dematerializing part of the currency in circulation to give rise to a parallel digital market. The Euro would be the link between the two dimensions, but the ECB intends to ensure that this cannot distort the market, cannot cause security problems and cannot get out of hand once it is started.

Hence a series of careful in-depth studies in various directions:

the potential effects (pdf) the legal considerations (pdf) the possible paths (pdf) the technical and organizational approaches (pdf) The idea is that according to which the digital European currency could function on a mixed structure in which between the banks there is a circulation with centralized control, while between the people there would be a decentralized structure. But this is still only one of the hypotheses in the field, because at the moment the discussion remains completely open to any evolution.

The decisions will be made towards the middle of 2021, which means that the construction site is officially open: a public consultation (pdf) will be an integral part of the project since only through open participation will it be possible to guarantee maximum transparency and maximum collaboration in view of the birth of a new type of circulating value.

Source: ECB